What is the reach of California’s carbon disclosure and climate risk laws?

A lot of AI generated ink had been spilled over California’s carbon and climate risk disclosure laws. But what are the impacts to entities based in other states? Are they off the hook? Let’s walk through the issues and considerations.

Photo by Michael Discenza on Unsplash

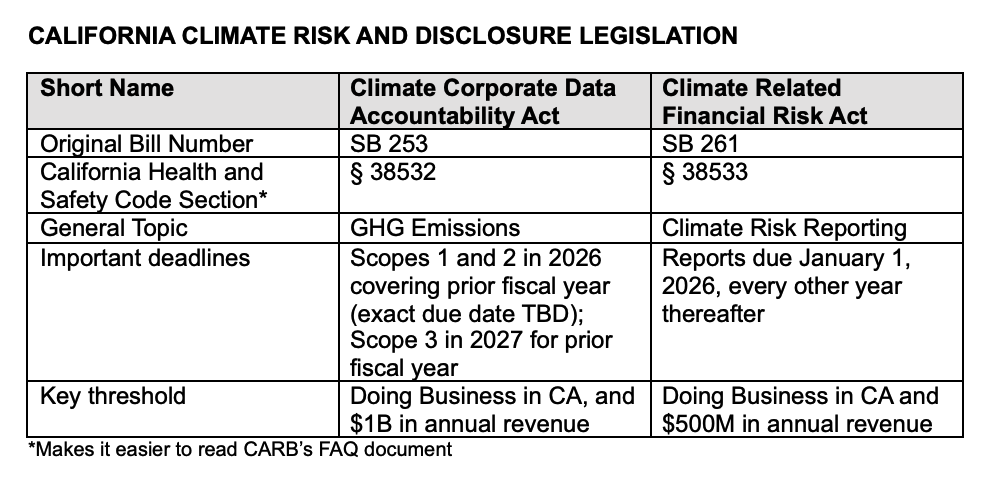

But first, a quick refresher on California’s carbon disclosure and financial risk laws, SB 253 (GHG Emissions) and 261 (Climate Risk Reporting). In 2023, California took a strong leadership position by enacting two sweeping climate laws. Since then, the laws have been amended, challenged in litigation, and proceeded (slowly) through the rule making process. Other states, including Washington, attempted to implement similar legislation (SB 6092, but spoiler alert, Washington’s 6092 didn’t go anywhere).

We created a handy chart to help summarize the various considerations and requirements, as they currently stand (as of July, 2025):

Despite the looming timelines - including SB 261 reports due in about 5 months - significant questions remain regarding the applicability of these new laws, including the scope of companies that are impacted, timelines, and what exactly is required from a reporting standpoint (more on that in our next post).

Many of these questions still remain, despite the California Air Resources Board’s (CARB) recently publication of an FAQ document (which explicitly states it does not have the force of law). Link to CARB’s FAQ document, here.

Let’s walk through what the FAQ document covers (and does not cover):

Entities will want to consider at least two key questions:

There is a lot to consider and quite a few unknowns, but companies will want to consider if they meet the revenue thresholds and if they would be considered “doing business in California.”

1. Do we meet the revenue thresholds?

Revenue is a complex question, and it is entirely possible that a company would be subject to 261 but not 253; if, for example, revenue was $750,000. But how, exactly, should companies calculate their revenue? According to the FAQ document:

“To determine total revenue for a company, the initial staff concept is that “total annual revenue” would be defined as gross receipts as set forth in California Revenue and Taxation Code § 25120(f)(2).” (emphasis added).

We will let the tax lawyers dig into that one. But one big, additional question remains, particularly for out of state entities - how much of that revenue should be considered “California revenue.” Here’s CARB’s clear as mud answer:

2. Are we “doing business in California”?

This is a threshold question for both 261 and 253, and it is a tricky one. According to the FAQ document:

“An entity is considered to be “doing business in California” for purposes of the reporting regulation if: (1) the entity is actively engaging in any transaction for the purpose of financial or pecuniary gain or profit …

AND “if any of the following conditions are met during any part of a reporting year:”

the entity is organized or commercially domiciled in California

sales exceed certain thresholds

real and tangible property in California exceed certain thresholds

amounts paid for compensation in California exceed certain amounts

These bullets are obviously a summary, and the full text of the relevant FAQ section is below. While there is a specific call out for entities based in California (which makes sense), the other three aspects are designed to cast a relatively wide net, including bringing many companies domiciled in other states into the purview of reporting.

And for those professionals and consultants working in building design, construction and operations, the key is really the value of real property in the state, which is a pretty low threshold, “exceed the lesser of the inflation adjusted thresholds of seventy-three thousand, five hundred two ($73,502) (2024) or 25 percent of the entity's real property and tangible personal property.”

What’s the takeaway?

It is also important to keep in mind that these are CARB’s preliminary guidelines and ideas - not law (at least not yet). But this is helpful guidance for companies to start preparing (Kristina Wyatt’s LinkedIn post is also helpful, link here).

If your company is based in another state, you should still go through the analysis of whether or not SB 253, SB 261, or both, apply. If you need help, contact us.

Finally, in a bigger picture sense, CARB has made clear that SB 261 reports will be made public and posted on a public website. This can either scare you or inspire you. And this type of legislation - which is the anecdote to “greenhushing” - may ultimately force your hand.

Full text of CARB’s FAQ #5:

An entity is considered to be “doing business in California” for purposes of the reporting regulation if: (1) the entity is actively engaging in any transaction for the purpose of financial or pecuniary gain or profit (Cal. Revenue & Taxation Code § 23101(a)); and (2) any of the following conditions is met during any part of a reporting year (Cal. Revenue & Taxation Code § 23101(b)): (1) The entity is organized or commercially domiciled in this state. (2) Sales, as defined in Revenue and Taxation Code subdivision (e) or (f) of Section 25120 as applicable for the reporting year, of the entity in this state exceed the inflation adjusted thresholds of seventy hundred thirty-five thousand and nineteen ($735,019) (2024). For purposes of this paragraph, sales of the entity include sales by an agent or independent contractor of the entity. For purposes of this paragraph, sales in this state shall be determined using the rules for assigning sales under Sections 25135 and 25136, and the regulations thereunder, as modified by regulations under Section 25137. (3) The real property and tangible personal property of the entity in this state exceed the lesser of the inflation adjusted thresholds of seventy-three thousand, five hundred two ($73,502) (2024) or 25 percent of the entity's real property and tangible personal property. The value of real and tangible personal property and the determination of whether property is in this state shall be determined using the rules contained in Sections 25129 to 25131, inclusive, and the regulations thereunder, as modified by regulation under Section 25137. (4) The amount paid in this state by the entity for compensation, as defined in subdivision (c) of Section 25120, exceeds the inflation adjusted thresholds of seventythree thousand, five hundred two ($73,502) (2024) or 25 percent of the total compensation paid by the entity. Compensation in this state shall be determined using the rules for assigning payroll contained in Section 25133 and the regulations thereunder, as modified by regulations under Section 25137.

DISCLAIMER: This is common sense, but bears repeating: this blog is intended for informational purposes and does not contain or convey legal advice. The law is inherently fact specific. General information, including this blog, should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.